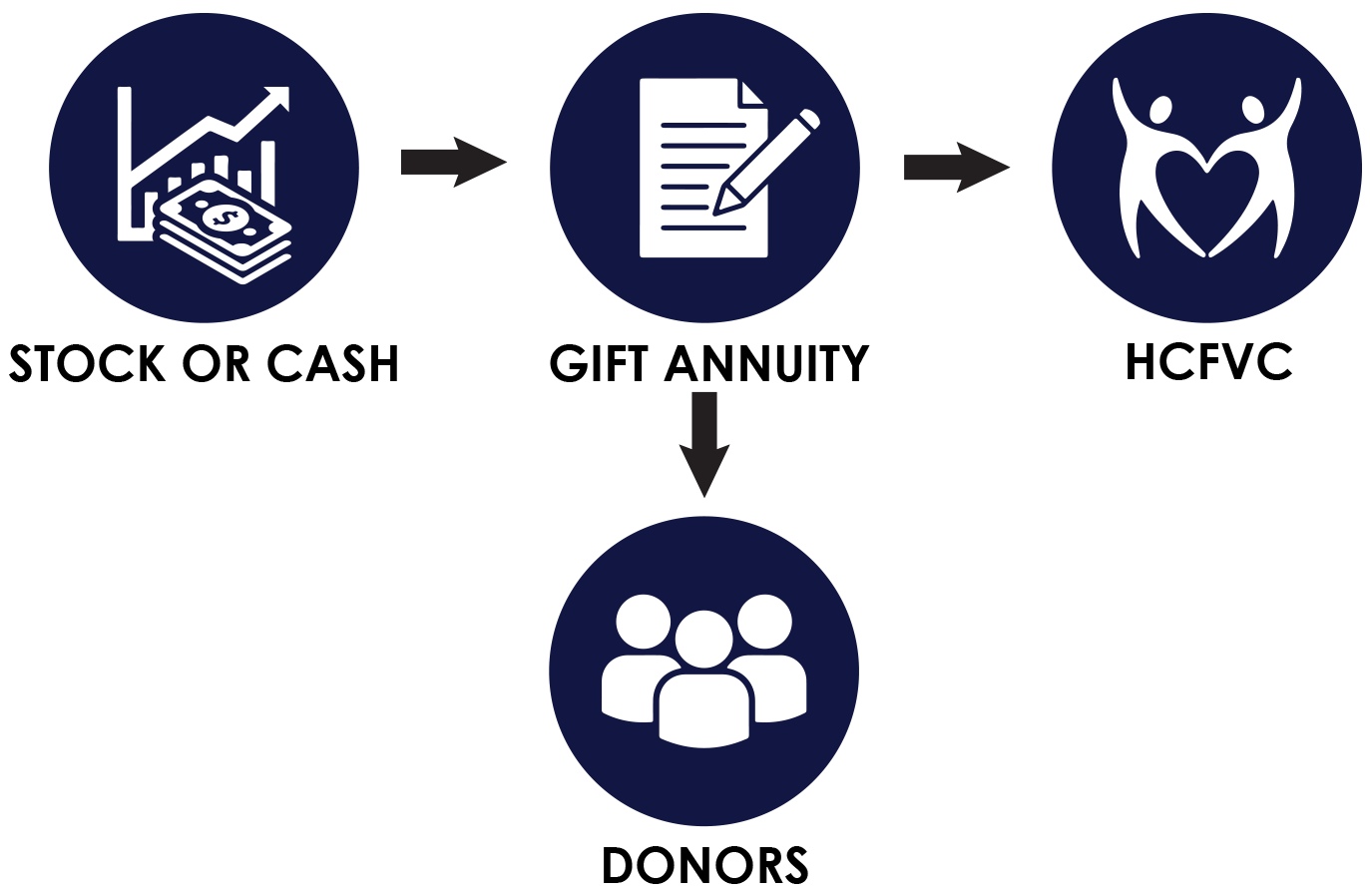

Dealing with the uncertainty of stock and real estate markets during retirement can be challenging. A charitable gift annuity is a gift made to Health Care Foundation for Ventura County (HCFVC) that can provide a secure source of fixed payments for life.